If you haven’t heard of Warren Buffet, then you must be very young.

This multimillionaire is considered to be one of the most successful investors of all time.

He created his wealth firstly by educating himself, then following very strong investment principles and forming good money habits. He is known for many popular quotes relating to long term investment goals.

This month we are going to look at how a few of his famous quotes may apply when deciding to purchase an investment property.

In the wake of a tumultuous 12 months in the finance and property industry, it’s natural to feel cautious and uncertain about what lies ahead for the remainder of the year. This may lead you to question if it’s a favourable time to enter the property market, whether as a novice homebuyer or an experienced investor.

There appears to be a plethora of conflicting viewpoints on what the future holds for the next few years, and there is no scarcity of ‘apparent experts’ offering advice on how to manage our finances, mortgages, property sales and acquisitions, savings and investments.

In April, there were indications that the property market could be shifting. Most major cities experienced a slight but positive growth for the first time in a year as well as the cash rate being on hold for the first time in 11 months.

So what is the speculation on interest rates, inflation and property prices this year?

Again, it’s hard to find any certainty and consistency amongst our economists and industry experts, however what we have been reading is:

- Inflation is expected to stabilise and potentially fall later in the year.

- The cash rate, and subsequently interest rates, are expected to follow this pattern with CBA predicting the first rate cut should occur in the last quarter of this year.

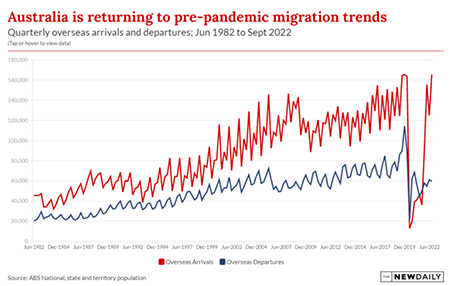

- Australia’s population growth is booming with a record high net overseas migration intake and a stable natural increase.

- There is limited supply of housing to accommodate the pending growth.

- Cost of rental accommodation is still through the roof (according to Westpac) with an expected 11.5% rise in rents this year on top of the recorded 10% increase last year.

In addition to the above points, the first of three white papers released by PEXA in February 2023 found ‘little evidence that interest rates are the sole driver of house prices over the long term, with price growth strong and consistent over 50 years regardless of whether long-term interest rates were high or low.

So what does this mean for investors?

Buffett is an exceptional role model because he comprehends the cyclical pattern of the economy and investment markets. He doesn’t succumb to panic during a market downturn. Instead he possesses the education and expertise to capitalise on such a situation.

“The investor of today does not profit from yesterday’s growth.” Warren Buffet

The problem with buying a property purely for capital growth it is that we don’t have a property crystal ball.

There appears to be two common drivers when it comes to making a decision about buying a property – or buying most things for that matter.

1. FOMO – Fear of missing out

We are tempted to buy while others are buying because we don’t want to miss out.

However, it may not always be wise to follow the herd and jump on the property bandwagon when others are, as this may occur when the market is close to its peak.

Then there is:

2. FOBE – Fear of buying early

We hold ourselves back from buying too early in case we make a mistake because property values may fall after our purchase.

Conversely to FOMO, it may be more beneficial to purchase during a buyers’ market when property is not as in demand providing you with a better chance of securing a good deal.

While timing the property market is not the ultimate solution, understanding its cyclical nature can certainly be helpful.

As Warren Buffet famously advised…

“Be fearful when others are greedy and be greedy when others are fearful.”

With the constant bombardment of property and finance news in the media, it can be challenging not to get swept up in the emotional rollercoaster.

While emotions have their place in everyday life, they

should not be the driving force when it comes to investing.

Another one of my favourite quotes from Mr Buffet when it comes to buying property is:

“Only buy something you’d be perfectly happy to hold if the market shut down for 10 years.”

And this one – “Our favourite holding period is forever.”

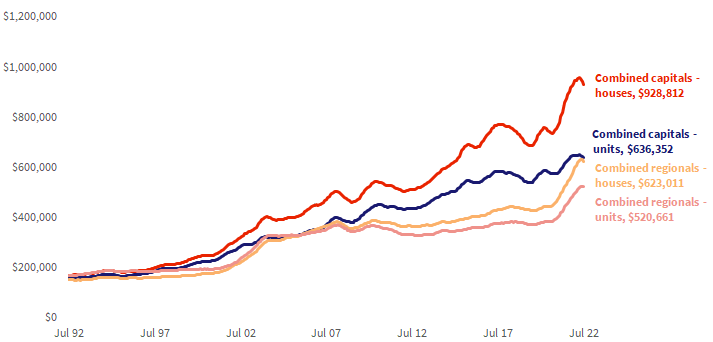

So what is the long term trend of housing prices in Australia?

You may not know that while housing values move through cycles of growth as well as declines, the long-term trend is undeniably upwards.

Nationally, dwelling values have increased 382% over the past 30 years. In annual compounding terms, they have risen by 5.4% pa on average since July 1992.

Median house and unit values, past 30years

Source: Core Logic

So although we cannot recommend whether you should or should not purchase an investment property or tell you if NOW is a good time to buy, if you would like to be prepared for when you feel the time is right for you then we can help you:

a) find out how much your home is worth,

b) determine the equity you have to use towards purchasing another property (or if you don’t have a property yet, you have a large enough deposit),

c) calculate your borrowing capacity and serviceability, and

d) connect you with specialists in the property industry to help you find a suitable property for you to purchase.

So please, reach out.

We would love to explore your options with you.

As always…

With your best interest in mind.

Regards,

Rukmal (Rocky) Wijesooriya

Note:

Our experience and professional services are governed by high standards inclusive of privacy provisions together with a well-established complaints process. We are governed and registered by ASIC, AFCA and FBAA for your protection of dealing with us.

A surge in consumer confidence rose last month after the decision to hold the cash rate in April at 3.6%.

Unfortunately, the Reserve Bank of Australia seemed to think another cash rate rise was appropriate at their meeting this month and has increased it to 3.85%.

No doubt lenders will follow suit and raise interest rates by 25 basis points.

Whether you are considering a new property or investment remember we are always here to help with your finance needs.

Reach out TODAY

02 9499 5697

Use this link to book a call/ zoom meeting: https://calendly.com/rukmal/

Intelligent Accounts and Finance

45A Spencer Road

Killara NSW 2071

02 9499 5697

0423547547

rukmal@

intelligentaccountsandfinance.

Australian Credit Licence: : 412778

Credit Representative Number: : 534206

ACN : 148919715

Disclaimer: This article provides general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances. Your full financial situation will need to be reviewed prior to acceptance of any offer or product. It does not constitute legal, tax or financial advice and you should always seek professional advice in relation to your individual circumstances.